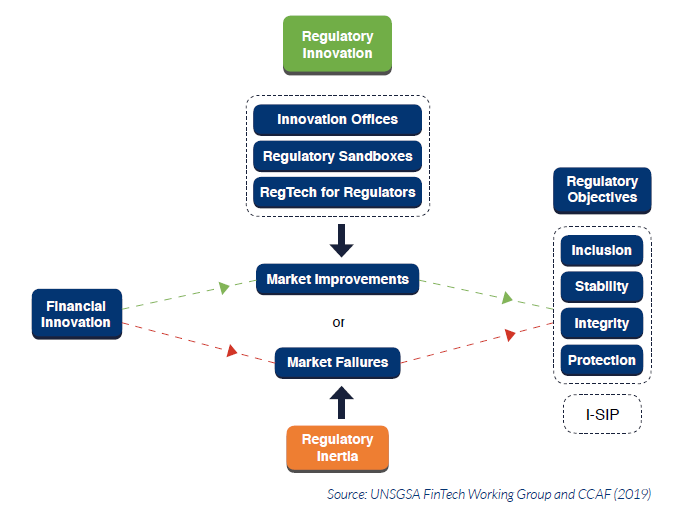

The UN, nothing less, has recently issued a report regarding the contribution of new technologies to the “financial inclusion”, i.e. the way everyone can understand and use financial services.

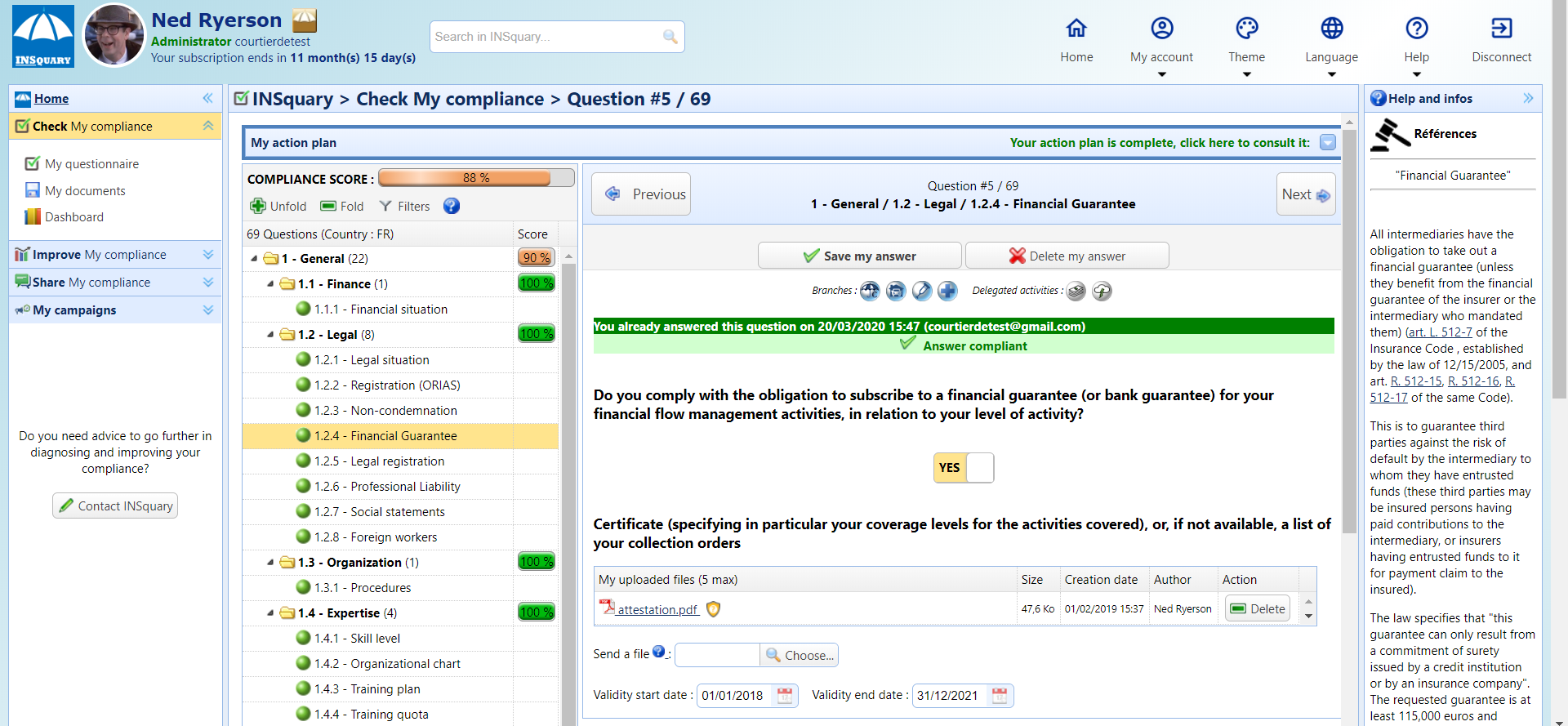

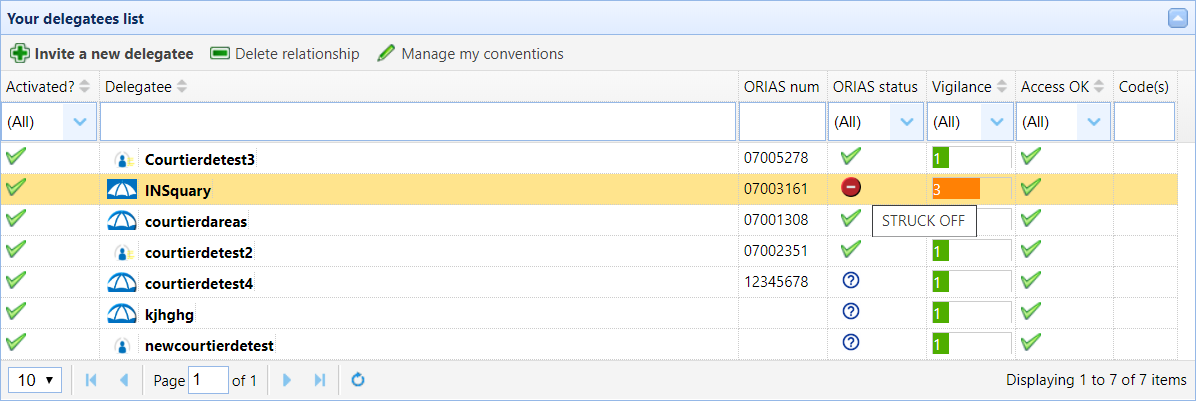

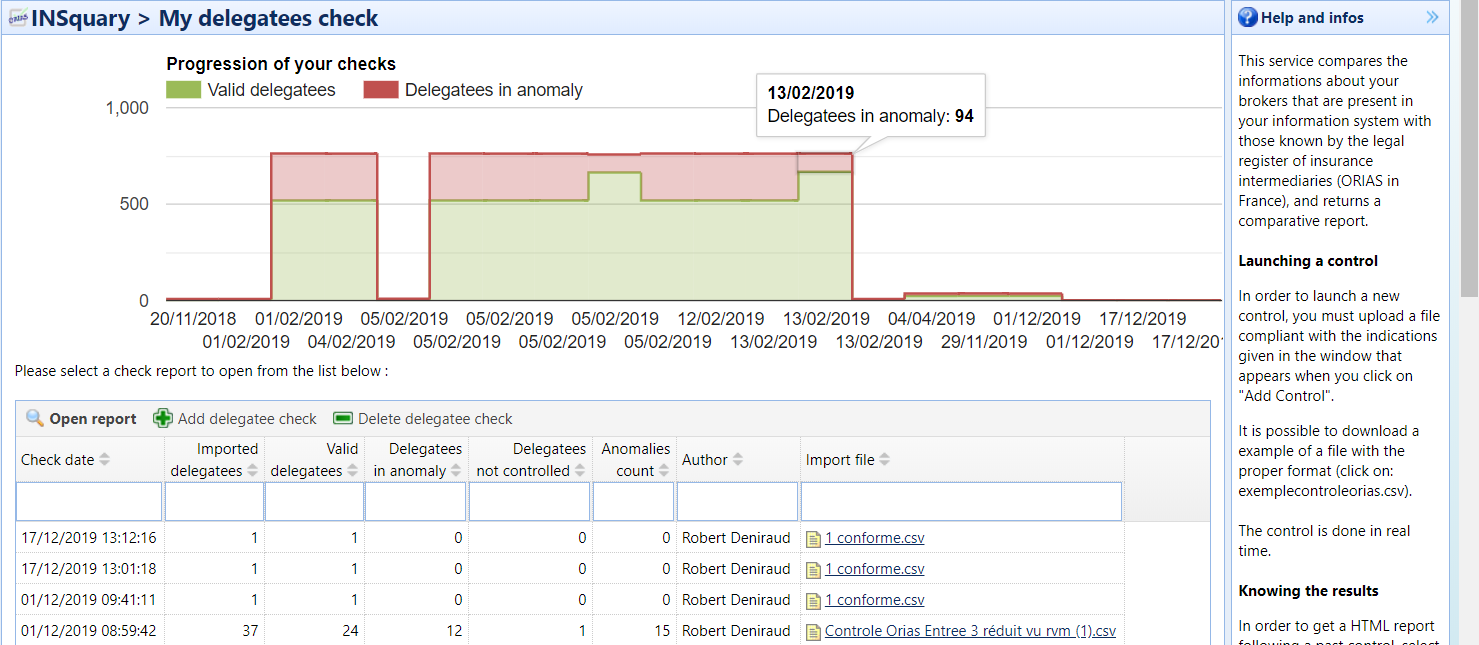

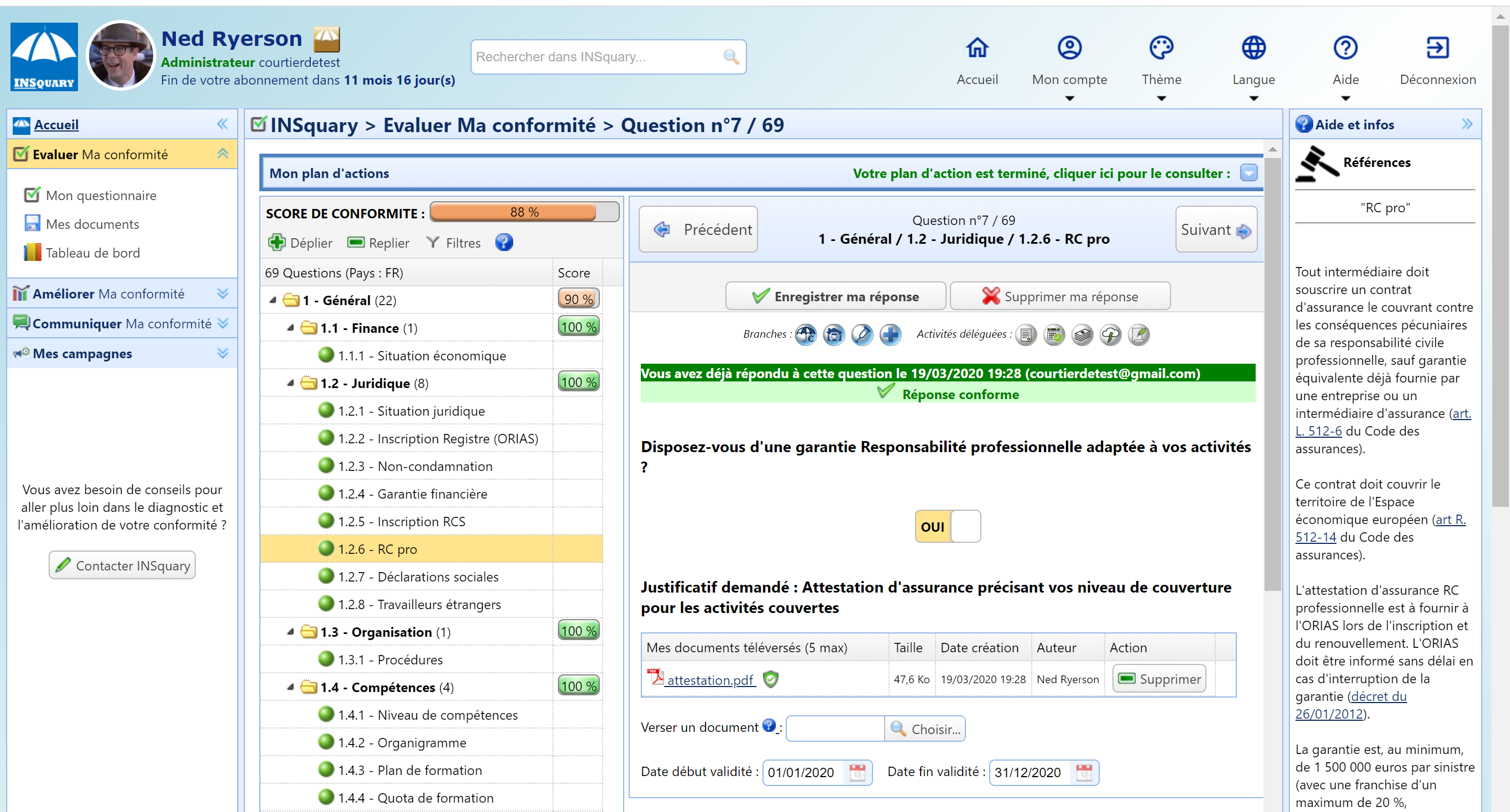

One of the chapters is devoted to “regtech”, that is to say, innovative companies that, like ours, apply the tools of mass data processing and exchange to the regulatory field. In the current jargon, they are distinguished from “legaltech” which produce legal services, for example, that format or help formulate contracts; and we even learn that they would be subdivided into “comptech” (companies that put technology to the service of compliance) and “suptech” (those that help the supervisor) – a nuance that tends to fade due to the the rise of delegated control and self-regulation.

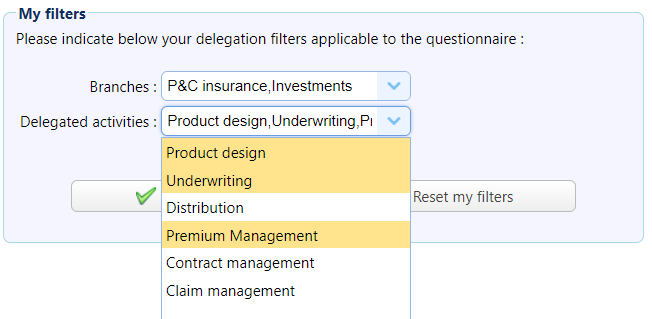

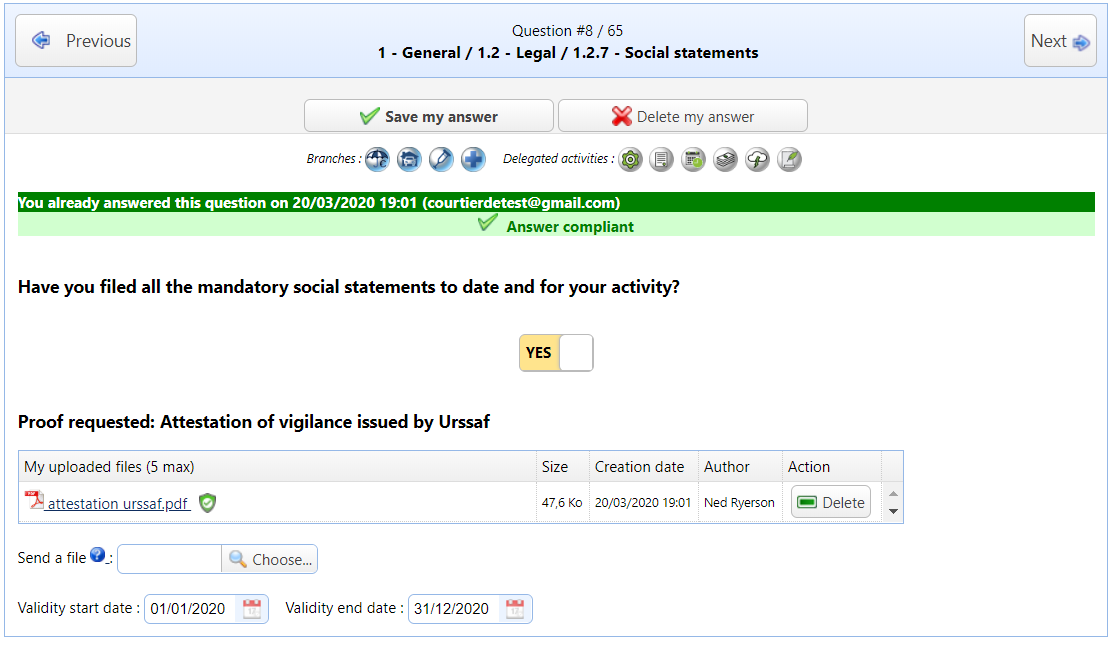

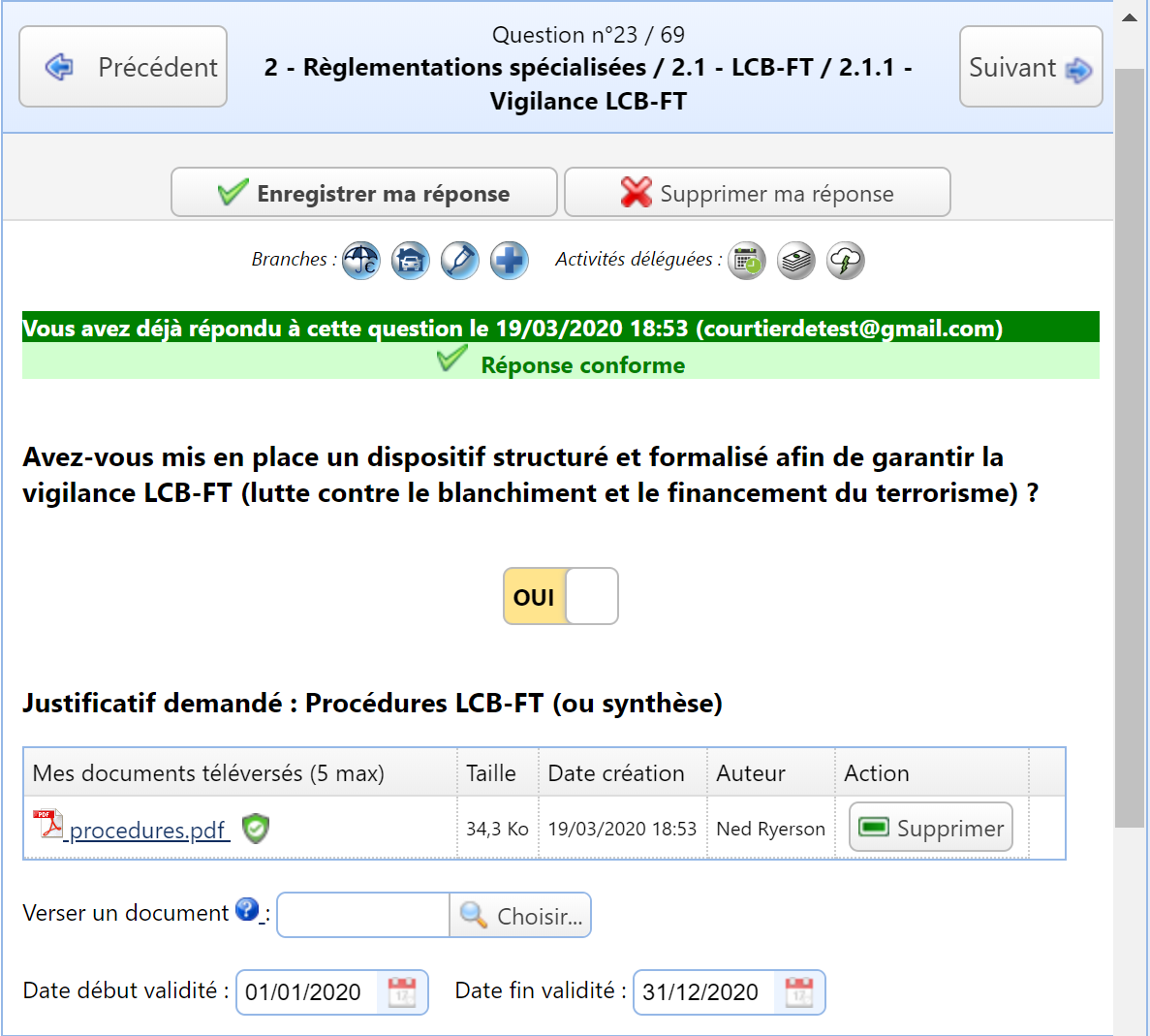

As, on one hand, the report uses a fairly technocratic language, and, on the other hand, your time is precious, we shall summarize its spirit as follows: well used, technology is a powerful factor of equality, especially in the field of the law applied to the financial sector. It is such a maquis that no one can pretend to master it perfectly. Specific financial regulations (AML, S2, IDD, … for specialists) are added to innumerable transverse regulations (social law, GDPR, …).

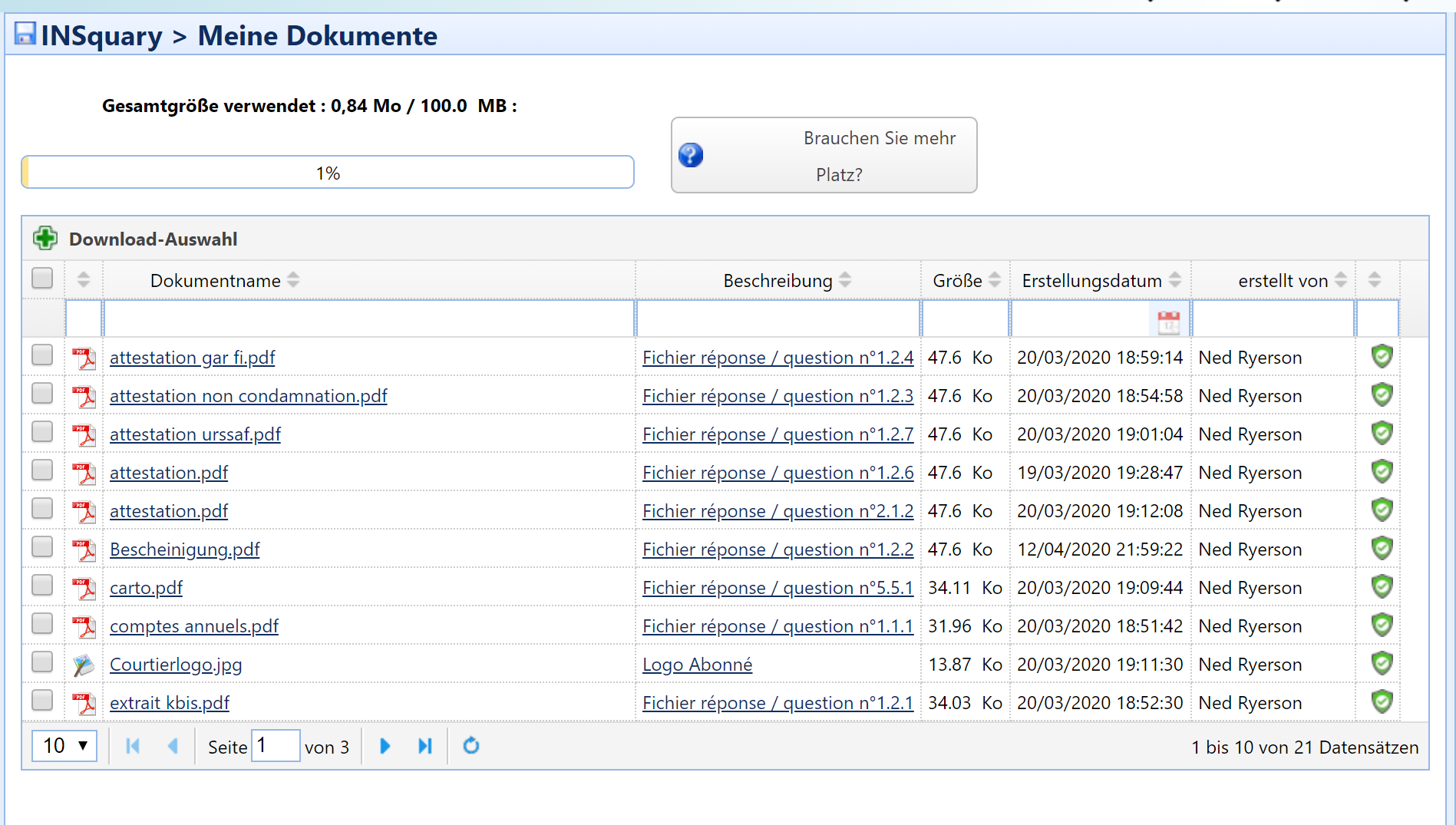

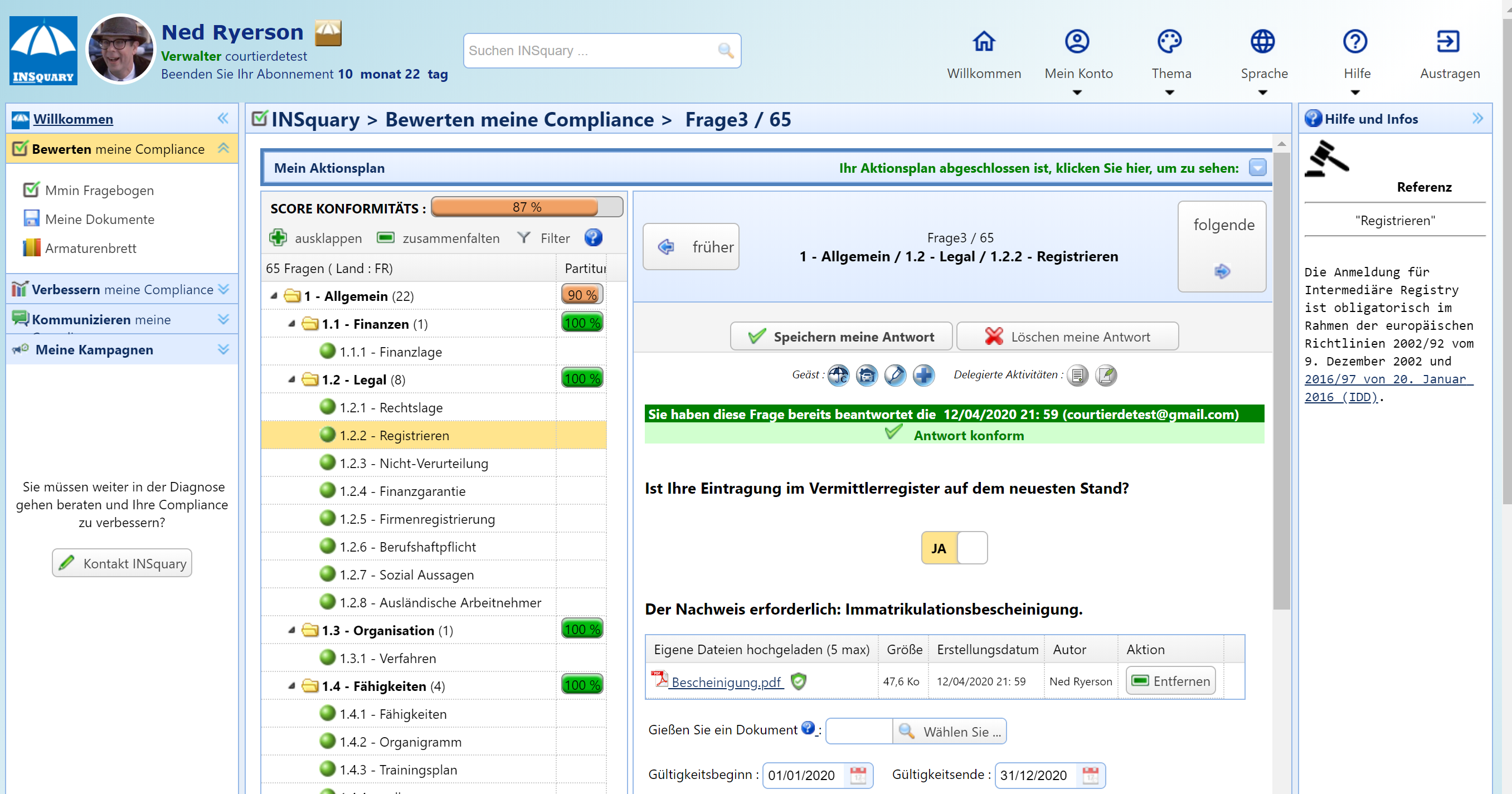

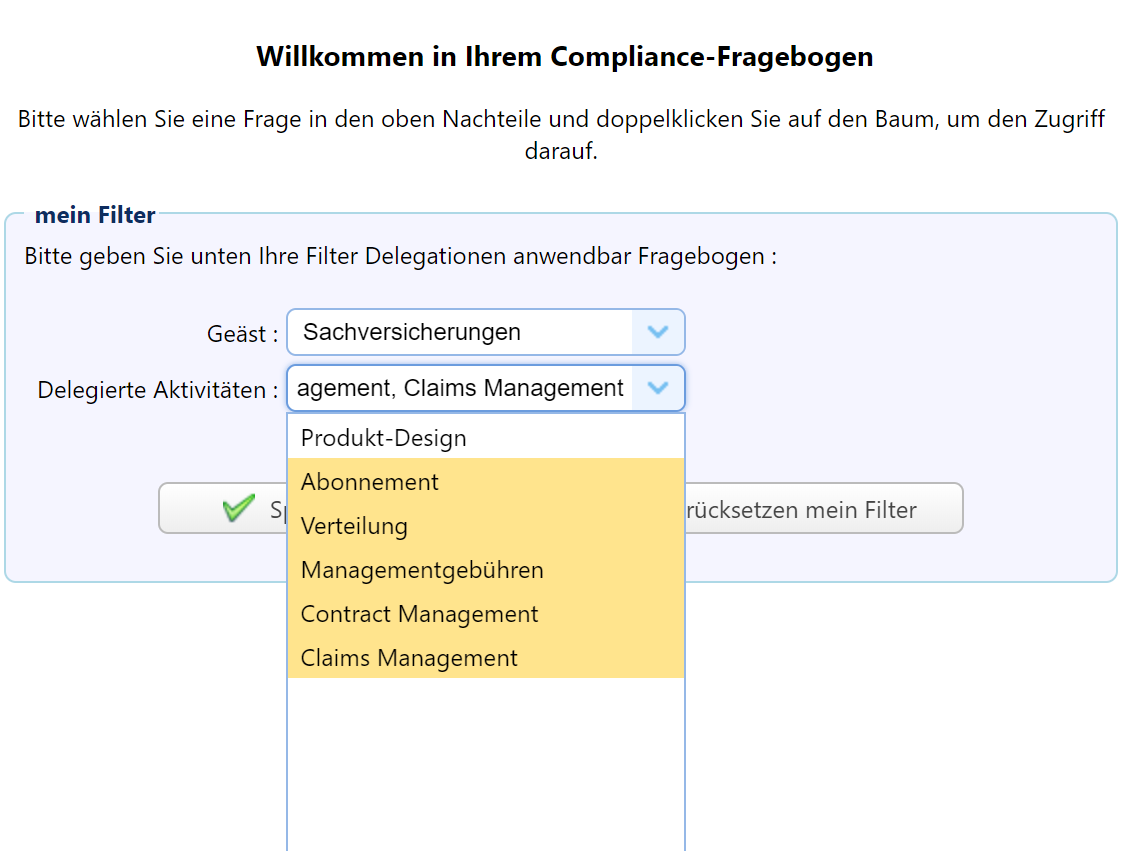

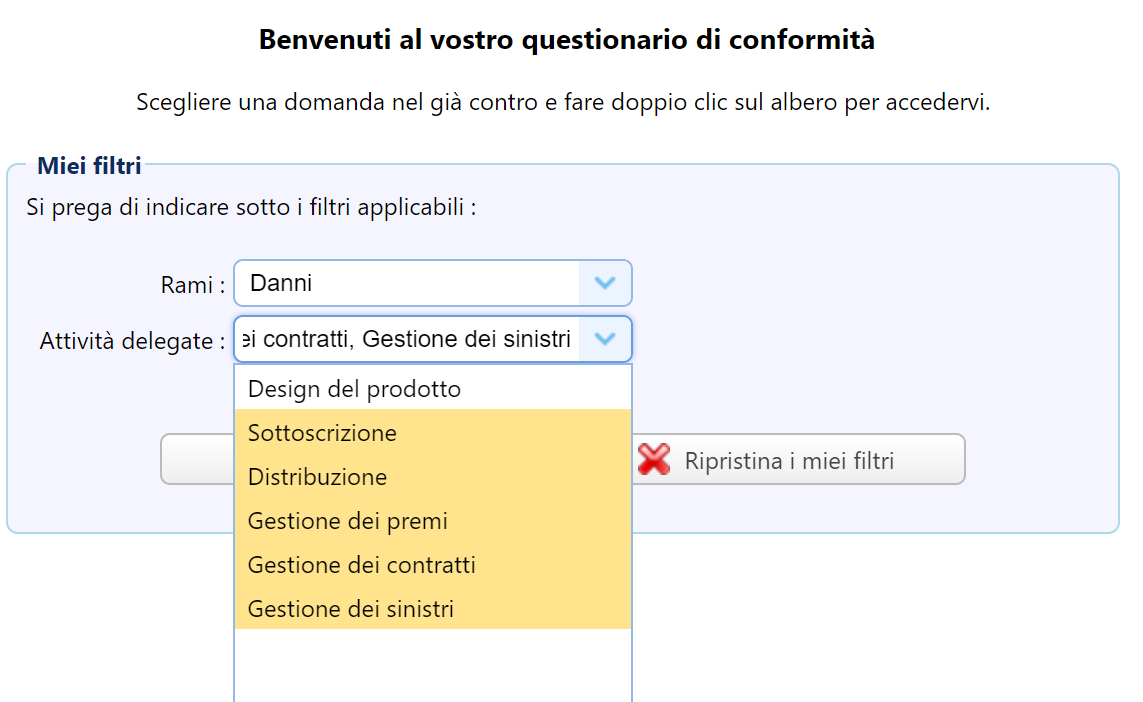

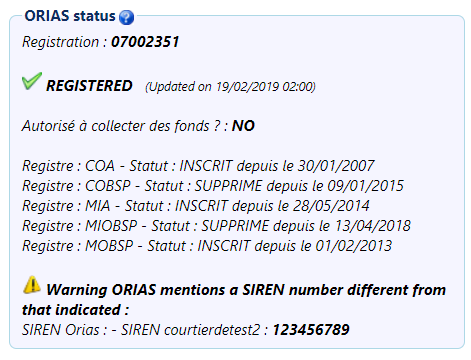

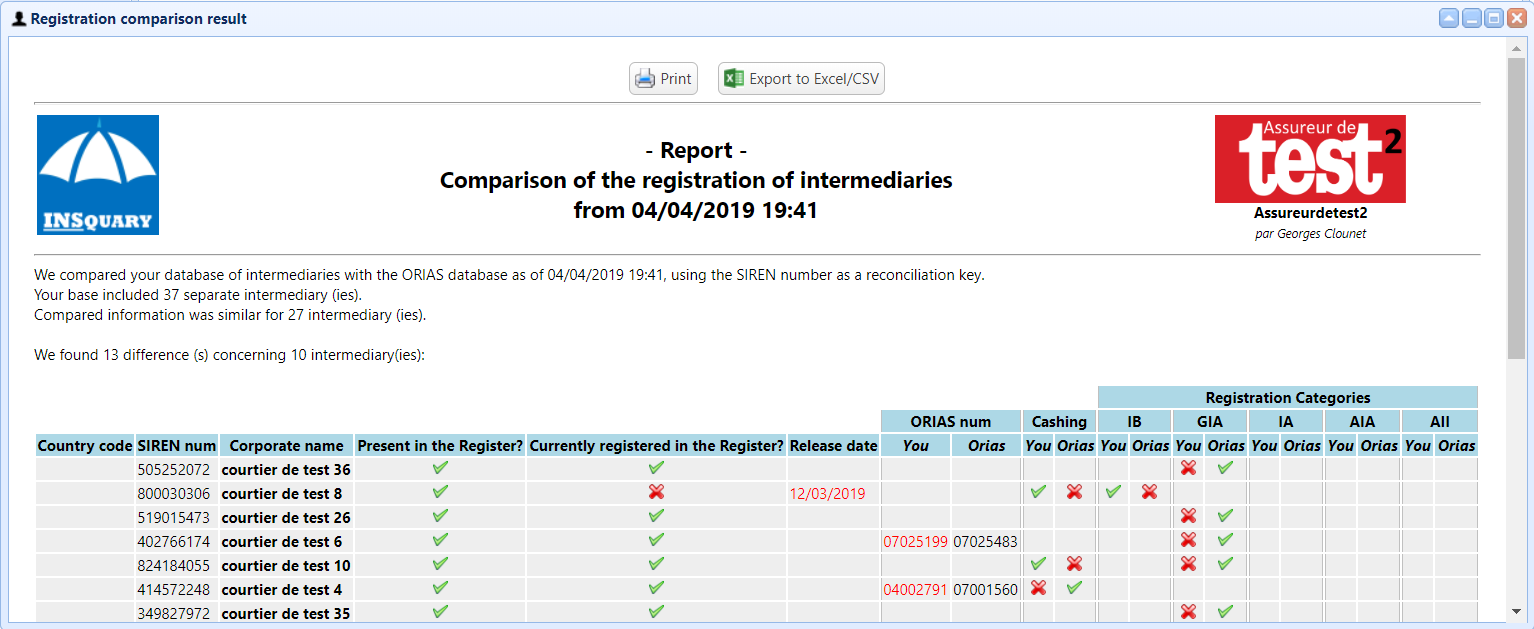

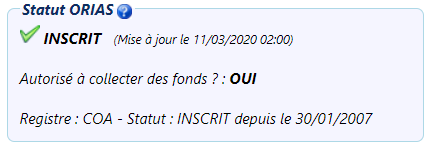

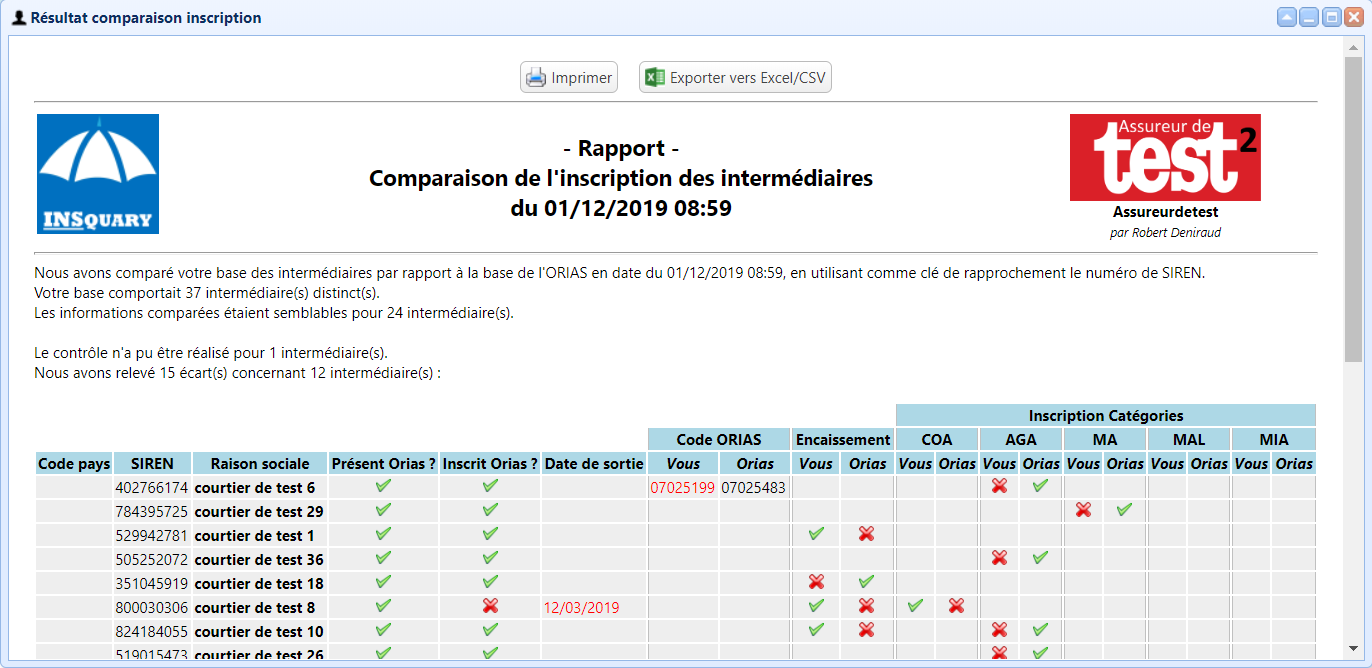

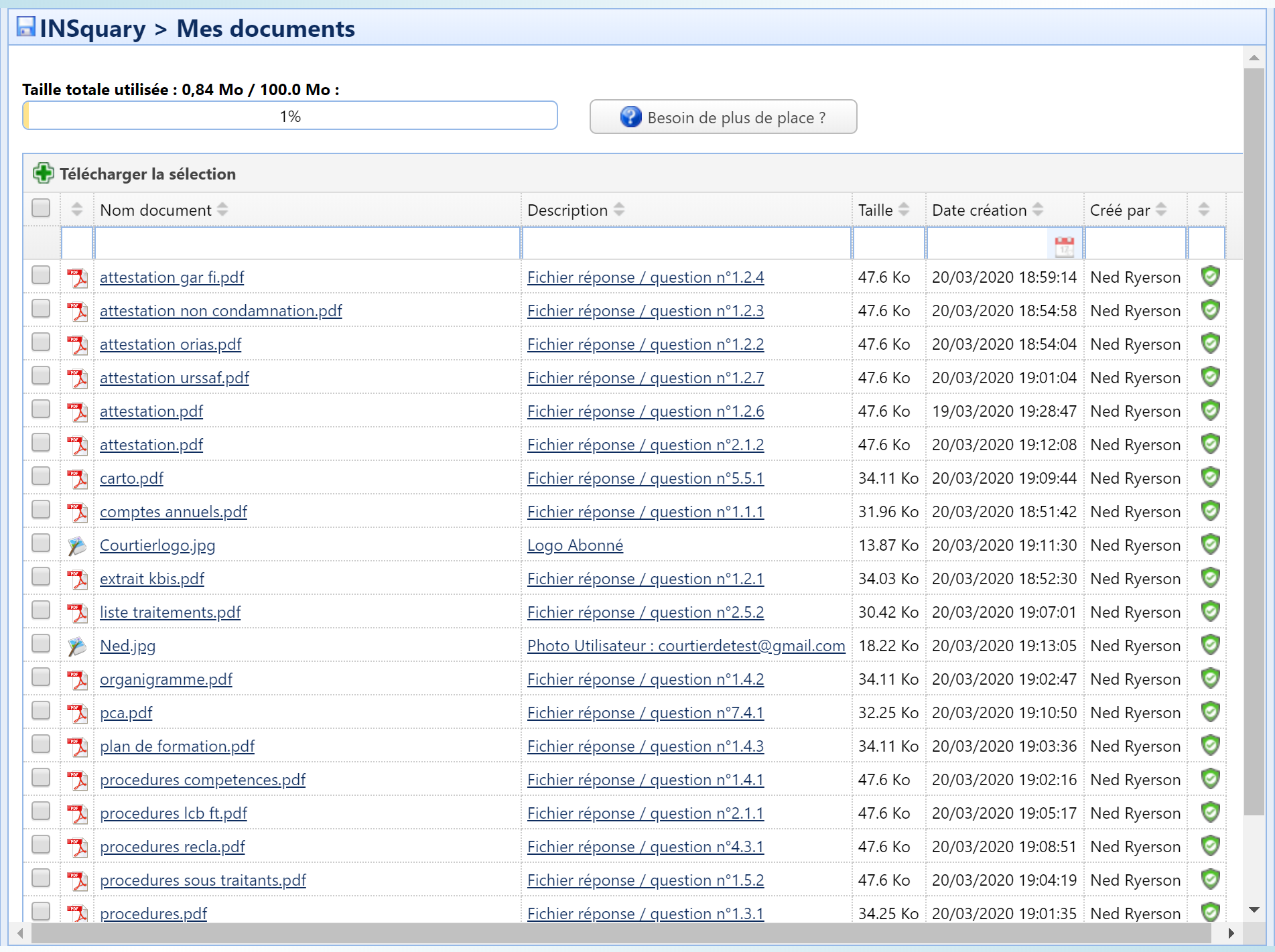

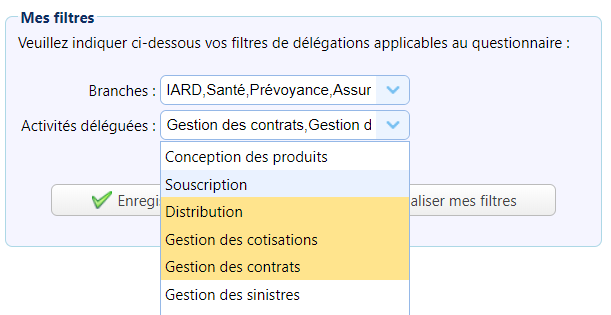

The process automation of compliance data eases the comprehension and thus the respect of the regulations; the pooling of regulatory data between stakeholders (consumers, professionals, regulators …); the trust between them; to way one deals professionally and in an organized way with the compliance work and regulatory data related thereto, and devotes to these works neither more nor less than the necessary time.